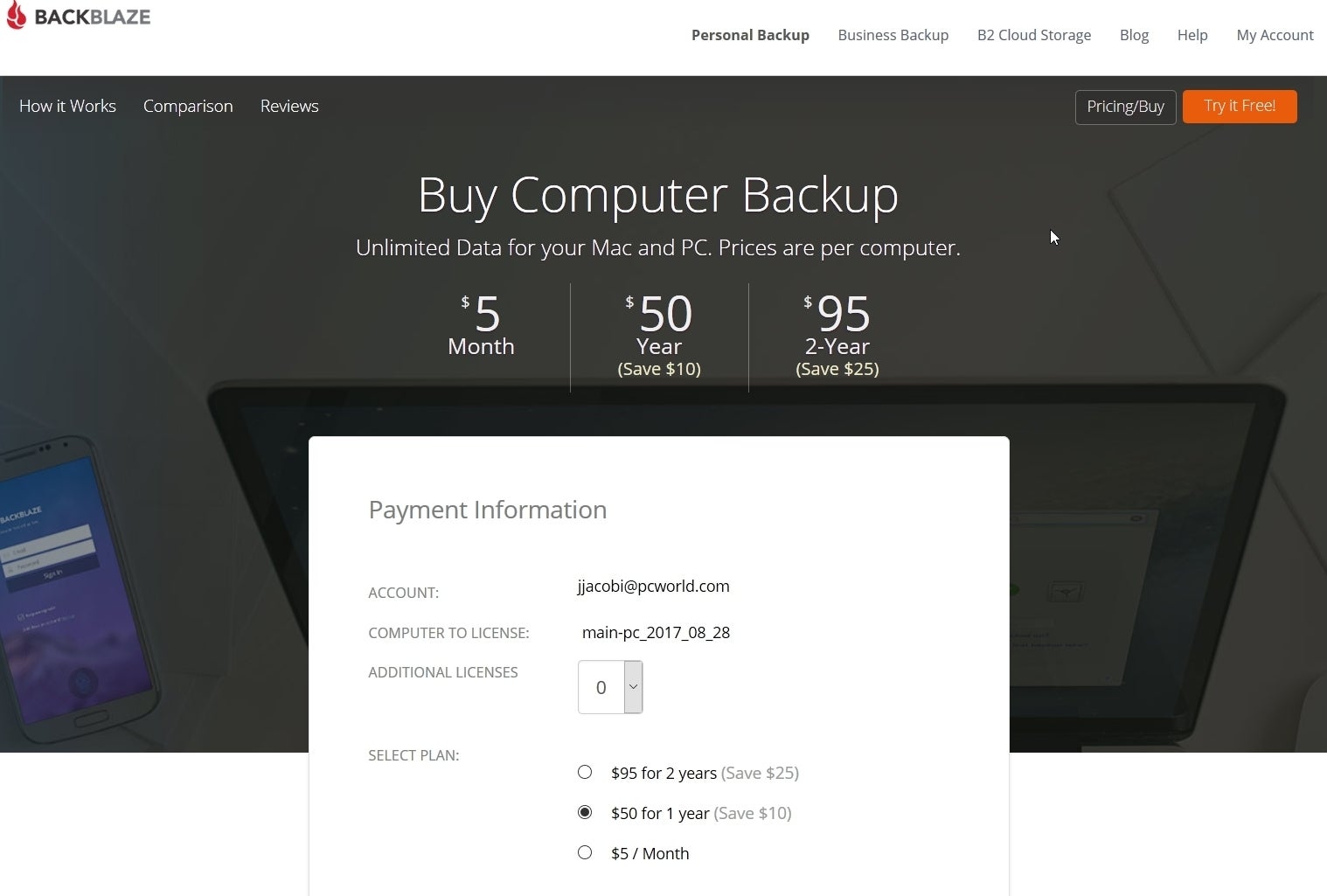

This can essentially provide the "bones" of an enterprise, the basis for all the company's digital operations. Its bigger cloud product, B2 Storage, plays more of an Infrastructure as a Service (IaaS) role, similar to Amazon Web Services or Microsoft Azure. It's more of a heavy-duty backup service that will come in clutch for business record-keeping.īackblaze offers different tiers for subscriptions - not only for additional storage space, but additional services like file versioning, history, and the ability to restore files with digital downloads or external drives. Its products are offered via monthly subscription, similar to Google Drive or Dropbox, except the purpose is more for continuous storage rather than manually saving specific files. It was founded in 2007 and has grown to have data centers in California, Arizona, and the Netherlands. provides cloud storage and data backup for both individuals and businesses. When those aren't available, revenue growth comes in handy.Īnd when all else fails, a big-picture look at the company's business model will do the trick. Profit numbers are always useful in that case. While companies don't often offer entire financial reports this early, a prospectus might still offer some helpful breadcrumbs to help decide whether the company is a buy. It contains helpful information like the company's mission, its intentions with the IPO, and details surrounding the business model, dividend strategy, and more. Robinhood users can also check out the prospectus from the SEC filing while there. You can search the Backblaze stock ticker "BLZE" on Robinhood right now for a chance to receive shares at the IPO price. Raymond James, Oppenheimer, William Blair, and others will be in charge of making the IPO happen. If the stock prices at the median of that range, that's a $100,000,000 IPO. Backblaze IPO Detailsīackblaze will offer 6,250,000 shares at a range of $15 to $17 per share. We're going to take a closer look at Backblaze stock to see if it's part of that winning half.įirst, here's the lowdown on the Backblaze IPO. In other words, nearly half of the IPOs Robinhood decided to share with retail investors have made at least 50% so far. And five of those seven still have gains of 50% or more. Of the 14 stocks that were available on IPO Access in the last year, seven are still making a profit for IPO investors. The platform has already shown the profit potential in IPO investing. (NASDAQ: HOOD), ordinary people can now swim in the same waters as venture capital and other "preferred" investors getting stocks at IPO prices. Thanks to IPO Access from Robinhood Markets Inc.

That's a window to profits most people have never had before. And retail investors have a shot at Backblaze IPO shares. Leave a Reply Click here to cancel reply.īackblaze stock goes public soon.

0 kommentar(er)

0 kommentar(er)